One of the ways Cashculator — Personal Finance helps you get a handle on your cash flow is by letting you set up a recurring plan for a type of income or expense that you receive or spend regularly. Your monthly rent or car payment would make sense, for example, to set up as a recurring plan and you can then choose to have the planned amounts automatically logged as actuals. But what if something changes?

Managing recurring plans in Cashculator used to be a bit of a hassle, but with the release of Cashculator 2.5, editing or deleting parts of a recurring plan is easier and more intuitive. Let’s dive into what’s improved.

Simplified Changes to Recurring Plans

Previously, modifying or deleting parts of a recurring plan involved a series of manual steps that were unintuitive, tedious, and prone to errors. Here are some examples of the challenges users faced:

- Adjusting the amount of a recurring transaction starting from a specific date: This required ending the existing recurring transaction earlier and creating a new one that was almost identical but started from a new date and had a new amount.

- Adjusting the amount of one transaction in a series: This was even more complicated, requiring users to create two additional manual transactions or come up with some creative workaround.

- Deleting a specific occurrence of a recurring transaction: To do this, you used to have to edit the existing transaction to end before the desired occurrence and then create a new, similar transaction that started after the deleted occurrence.

Handling adjustments to auto-generated actuals in these cases added yet another layer of complexity.

Here’s how it works now, in Cashculator 2.5: when you delete or adjust the amount in a recurring plan, Cashculator asks you which dates should be affected by the change and then performs all the necessary updates automatically. This includes adjusting dates for the existing plan and creating any new transactions needed to carry out your change.

Improved Deletion Options

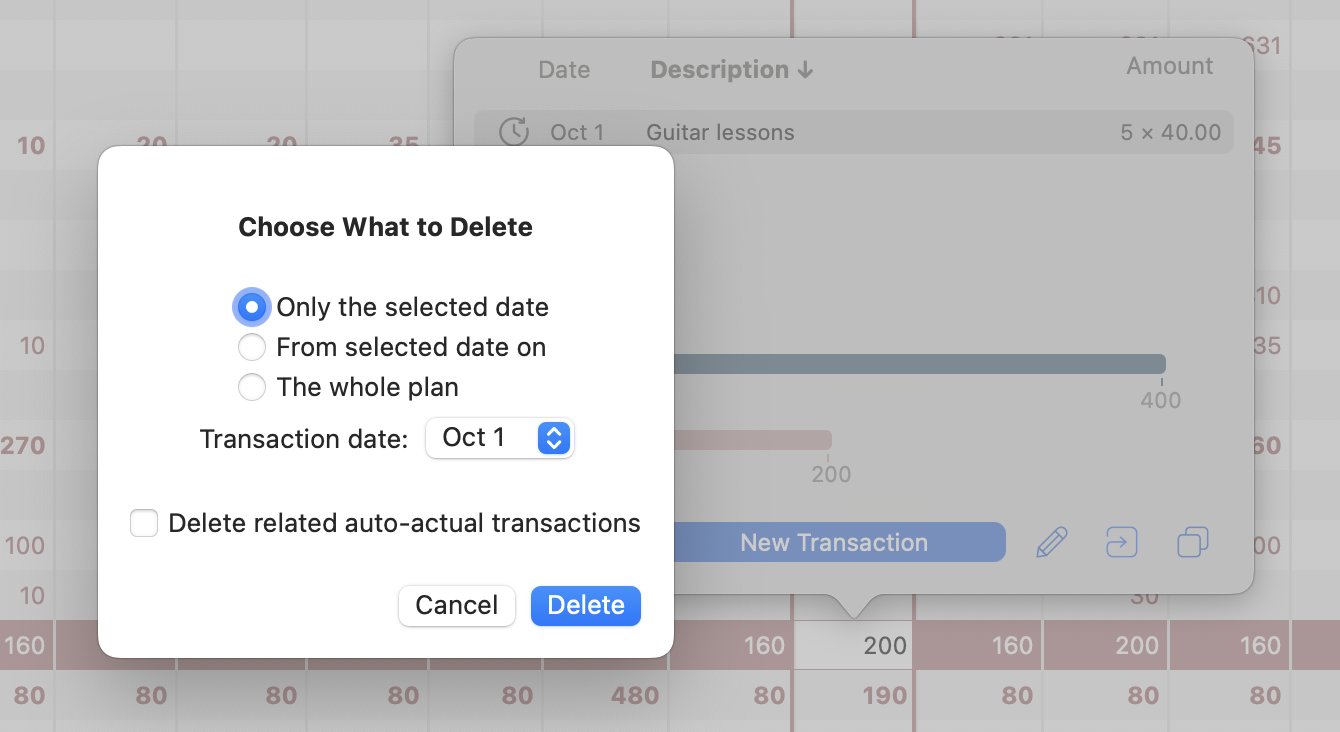

When you now choose to delete a transaction from a list of recurring transactions, you are presented with a panel offering the following options to specify what dates should be affected:

Only the selected date: allows you to delete just one specific occurrence of the plan. Cashculator will adjust the existing plan’s end date and create a copy of the transaction that starts after the skipped occurrence. If you have more than one occurrence in the selected column (say, 4 weekly occurrences in a monthly column), you can choose the specific occurrence from the list of dates.

From selected date on: allows you to remove all future transactions from a specific point onwards, leaving previous entries intact. Essentially, this is similar to adjusting the plan’s end date.

The whole plan: deletes the entire recurring plan. If you want to use this option without seeing the panel, just hold the Command key while clicking the delete button. This is how the delete button worked in previous versions of the app.

Additionally, there is a checkbox to include any related “auto-actual” transactions in the changes to the plan. This ensures that your plans and actuals remain in sync, even when adjustments are made after the fact.

A Smoother Experience

Our goal is to make managing your finances as smooth as possible. These improvements mean you can now make these changes to your plans without worrying about the technicalities of updating recurring items.

We hope these changes make your work with Cashculator more straightforward so you can better understand your cash flow and get back to focusing on whatever brings you joy and meaning in your life. We’d love to hear what else we can do to improve Cashculator for you! Write to us at support@apparentsoft.com and let us know.

Ready to take control of your spending?

Wish you could forecast future income, expenses and cash flow? Check out Cashculator — Personal Finance today.

Learn how the program works using the free version, then choose a monthly or yearly subscription to unlock unlimited income and expense categories.