Are you having trouble setting up a budget that spans across several bank or other financial accounts? If so, you’re not alone! Many people struggle with the same challenge. But, don’t worry, Cashculator is a flexible tool that can help you simplify this process. In this article, we’ll cover how you can manage multiple accounts with Cashculator.

What is Cashculator?

Cashculator is a personal finance application that helps you manage your financial situation. Unlike other personal finance applications, Cashculator doesn’t have a built-in notion of accounts. This means that there are several ways to go about it, but it also means that Cashculator is a simple tool that’s easy to use, much like a spreadsheet.

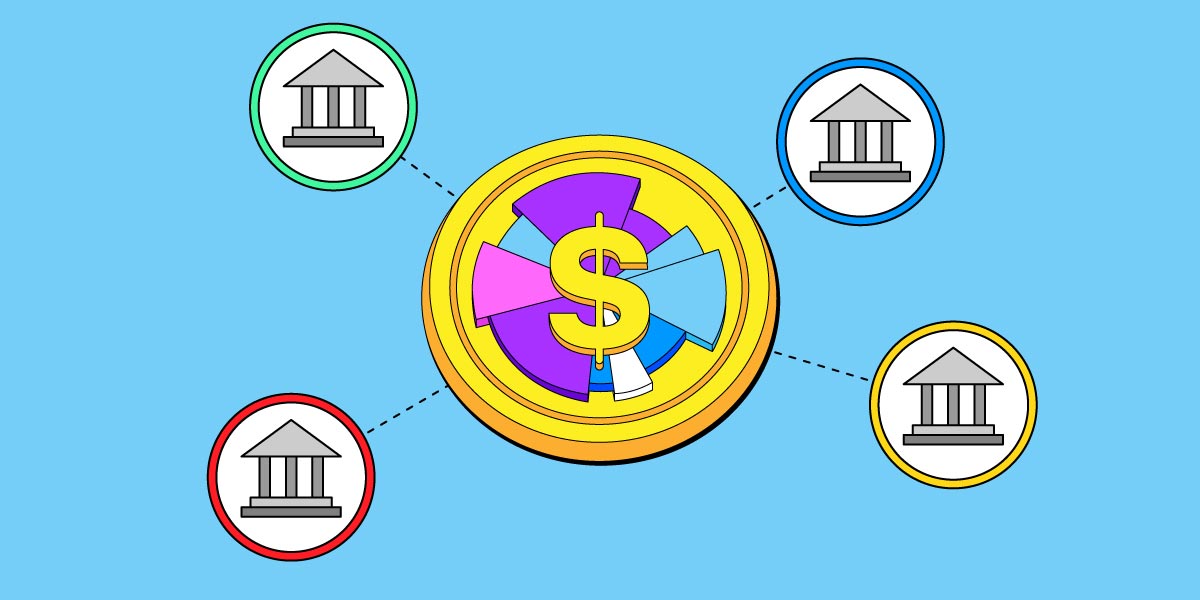

Four Approaches to Modeling Multiple Accounts

There are a number of reasons you may have more than one financial account. Maybe you spend and deposit into a checking account for day-to-day expenses, but keep a money market account where you’re saving up the downpayment for your first home. Maybe you’re a student using one account for scholarship funding and tuition payments and another for income and expenses outside your academic pursuits. Regardless of your situation, here are some ways to model your finances in Cashculator:

1. Take a bird’s eye view by combining all sources of income together as well as combining all expenses. We recommend this approach, initially modeling all your income and expenses within a single Scenario, to get the most of Cashculator’s financial forecasting.

2. Create a new budget file for each of your accounts. This can prevent you from seeing the larger picture of all your finances on a single screen but does keep things straight.

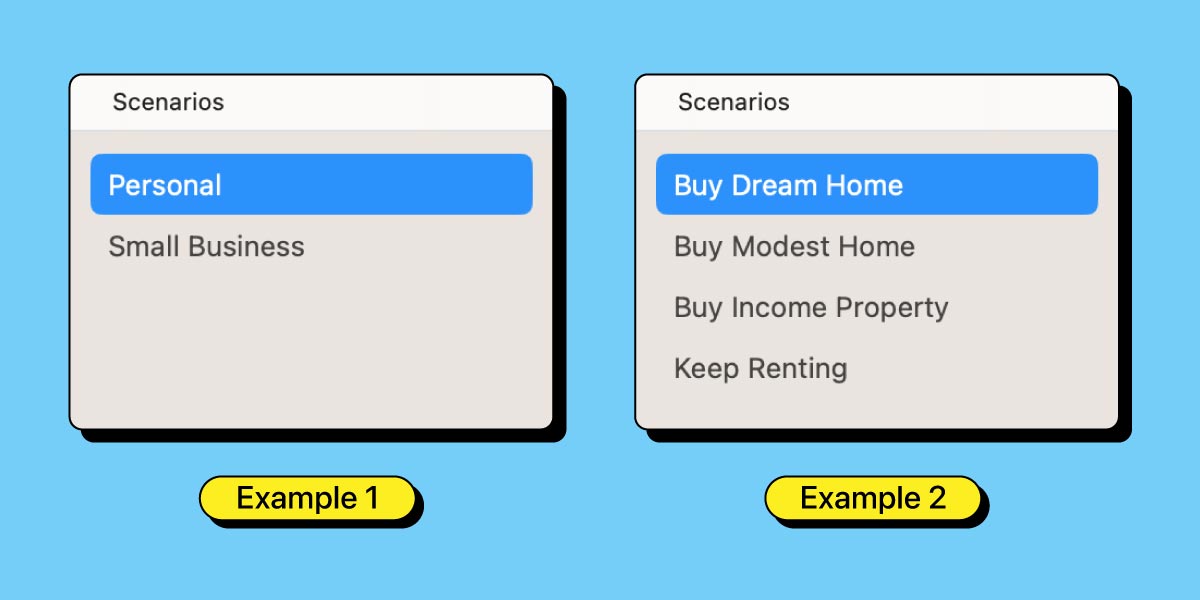

3. Create different Scenarios, one per account. This is similar to option 2, but a bit less drastic, since you can then at least cycle through viewing each account when you have the Scenarios sidebar open.

4. Create a Group for every account you wish to track, then duplicate the desired categories under that group.

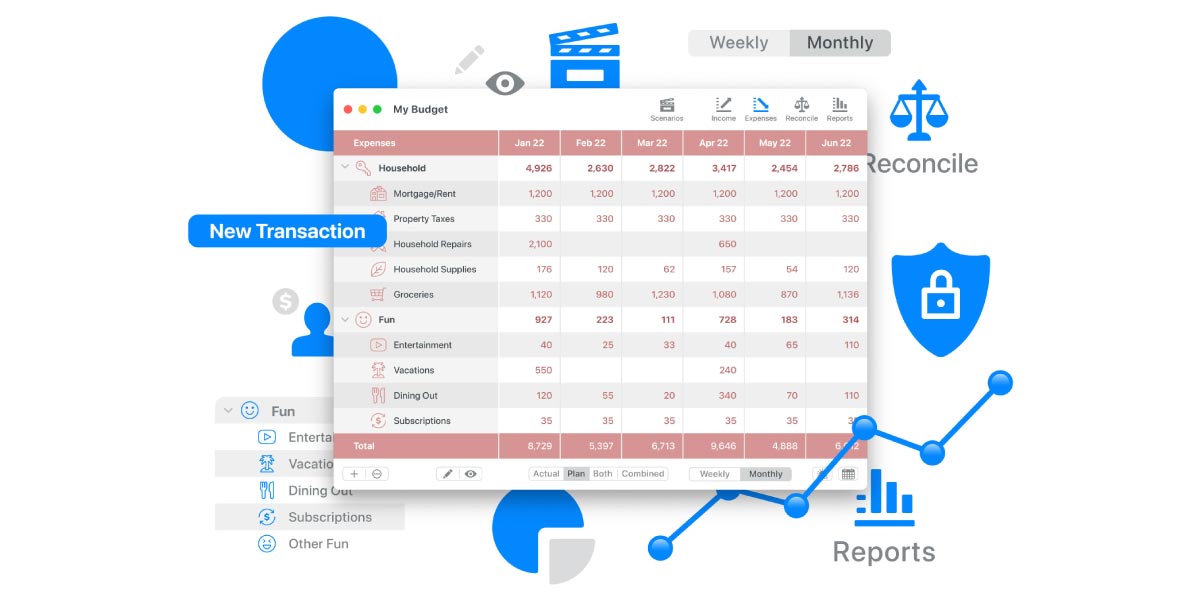

Combining Transactions into a Single Scenario

Since Cashculator doesn’t have the concent of accounts, the best way to manage multiple bank accounts is to combine all the transactions into one scenario. The Income, Expenses and Reconcile tables only care about categories, so if you have the same category in different bank accounts, you can lump transactions in any account into the same category. This way, you can easily see the big picture of your financial situation. However, if you want to split some of those transactions into different categories, you’re free to do so.

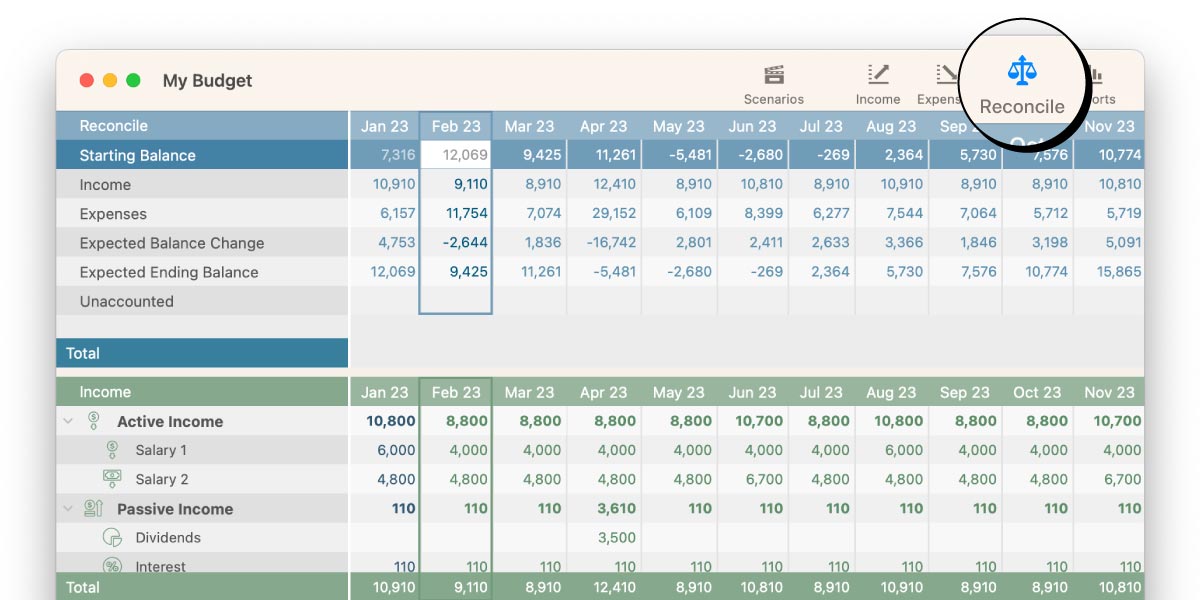

Balances and Reconciliation

Cashculator doesn’t actually care about the individual balance of your accounts, and nowhere do you need to enter individual balances. The only place where balance is used is on the Reconcile screen, and it’s important to set it there so that Cashculator can correctly forecast your future balance. However, this balance is a total of all your accounts plus cash (if you have cash on hand that you want to manage through Cashculator).

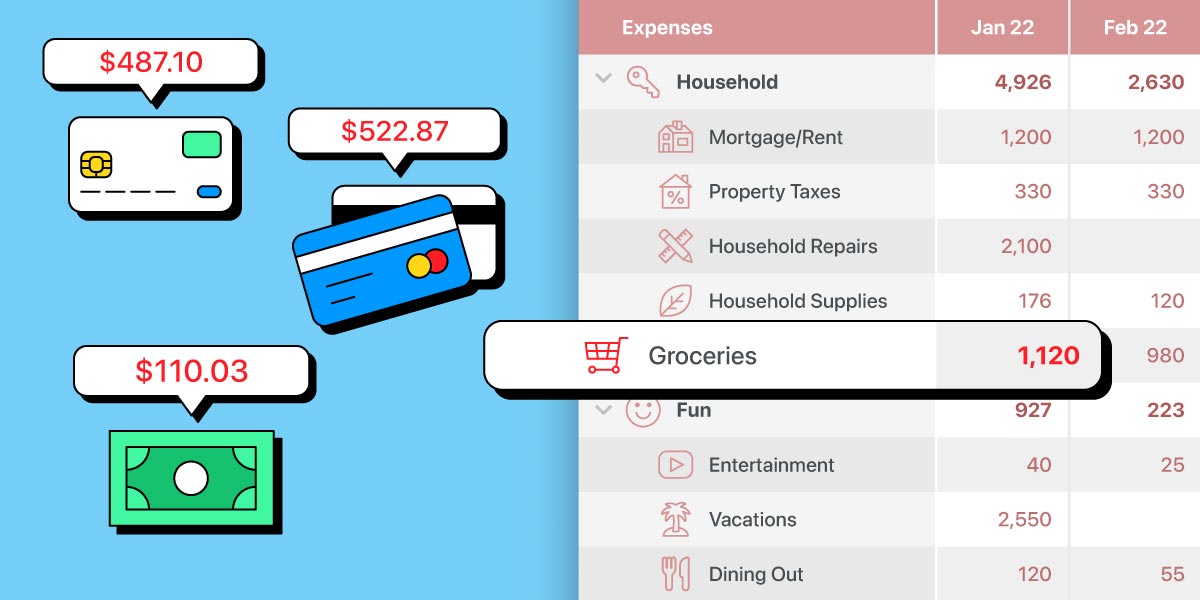

Cash Transactions and Balances

Cashculator doesn’t have accounts, so transactions that merely transfer funds between accounts (including withdrawal of cash from an ATM or deposit of cash that you had on your hand) don’t need to be entered into Cashculator since they don’t change your total balance. It’s important to remember that Cashculator is optimized to be used as a high-level tool for seeing the big financial picture, so it’s essential to keep cash transactions and balances in Cashculator so that you can get the full picture of your financial situation.

Managing Separate Accounts

If you want to keep separate tracking for separate accounts (for example, a personal account and a business account), you can use more than one document or create additional scenarios in the same document but handle the scenarios as separate accounts or areas of life. This way, you can get a more detailed view of each individual account while still having an overview of your total financial situation.

Final Thoughts

Cashculator is a bit different from most other personal finance applications, and it’s essential to understand how to use it correctly. The best way to get the most out of Cashculator is to think about what question you’re trying to answer with it, and then only do as much as needed in Cashculator to answer that question. Whether you’re trying to see where you’re spending most of your income or when you’ll be able to buy an expensive item or retire, Cashculator can help you get there.

We hope that this article has been helpful in showing you how to manage multiple bank accounts with Cashculator. If you have any questions or if you’re struggling with using Cashculator, please let us know. We want to understand where people struggle with using it and if what we explain about using it is helpful. This way, we can improve our documentation and create educational videos to better support our users.

View Cashculator’s Getting Started Guide from the Welcome Window or under the Help menu. There, you’ll also find Guides for key concepts like Categories, the Time Horizon, how to Reconcile, Reports and Scenarios.

Ready to take control of your spending?

Wish you could forecast future income, expenses and cash flow? Check out Cashculator — Personal Finance today.

Learn how the program works using the free version, then choose a monthly or yearly subscription to unlock unlimited income and expense categories.