Budgeting is a crucial part of managing personal finances. It helps us understand where our money goes, plan for future expenses, and save for our financial goals. The envelope budgeting system is one of the most effective and straightforward. This method involves dividing your income into different categories or “envelopes” for different expenses. Each envelope represents a category of your budget, such as groceries, rent, entertainment, etc. The key rule of envelope budgeting is that you can only spend what’s in the envelope. If you run out of money in an envelope, you either have to wait until the next month when you refill the envelopes or take money from another envelope.

But how can we implement this method in today’s digital age, where transactions are mostly cashless? Enter Cashculator – a powerful financial planning tool that can help you digitally implement the envelope budgeting method. This blog post will guide you on using Cashculator to manage your finances using the envelope budgeting method.

Understanding Cashculator and Envelope Budgeting

Before we delve into the specifics, let’s first understand the basics of envelope budgeting and Cashculator.

Envelope budgeting is a proactive budgeting system. You decide at the beginning of the month how much you’re going to spend in each category, and then you stick to that budget. This method is particularly helpful for people struggling with overspending or trying to get out of debt. It gives you a clear visual representation of how much money you have left for each category, which can help prevent overspending.

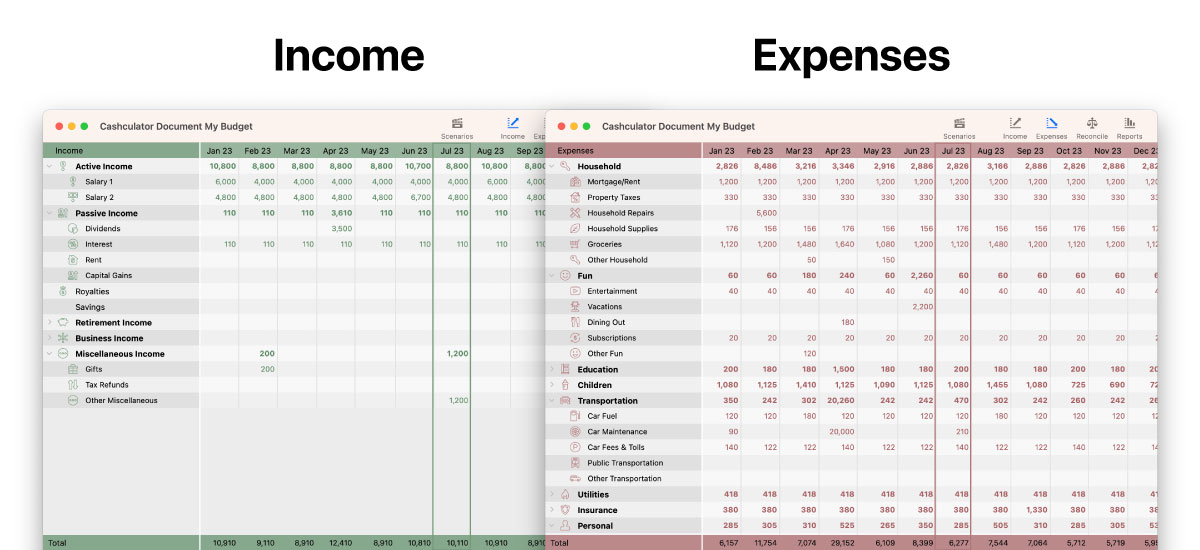

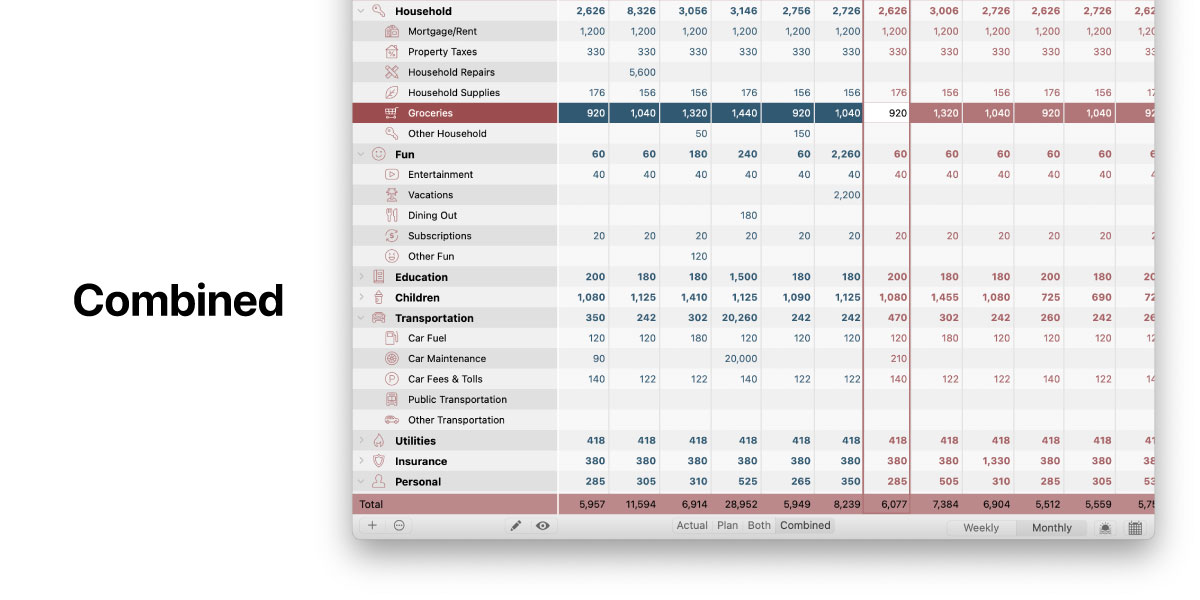

On the other hand, Cashculator is more than just a finance tracking tool. It’s a powerful planning tool that separates plan and actual data, allowing you to see how your actual finances compare against the plan you prepared. The application is based on the familiar concept of spreadsheet tables. There’s a table for income and another for expenses. Each column represents a range of dates, like a week or a month, and each row in a table represents a category or a group of categories. The default monthly view fits the envelope budgeting system perfectly.

By combining the principles of envelope budgeting with the features of Cashculator, you can create a robust system for managing your finances. In the following sections, we will guide you on how to set up your envelope budget in Cashculator, track your spending, compare your planned and actual spending, and adjust your budget as needed.

Setting Up Your Envelope Budget in Cashculator

Now that we’ve laid the groundwork let’s dive into the practical steps of setting up your envelope budget in Cashculator.

1. Identify your expenses: Start by identifying all your monthly expenses. These could include fixed expenses like rent or mortgage, utilities, and variable expenses like groceries, transportation, entertainment, etc.

2. Create categories for each expense: In Cashculator, you can create a category for each of your expenses. These categories are similar to the concept of envelopes in the envelope budgeting method. To create a category, add a new row in the expenses table and name it according to the expense it represents.

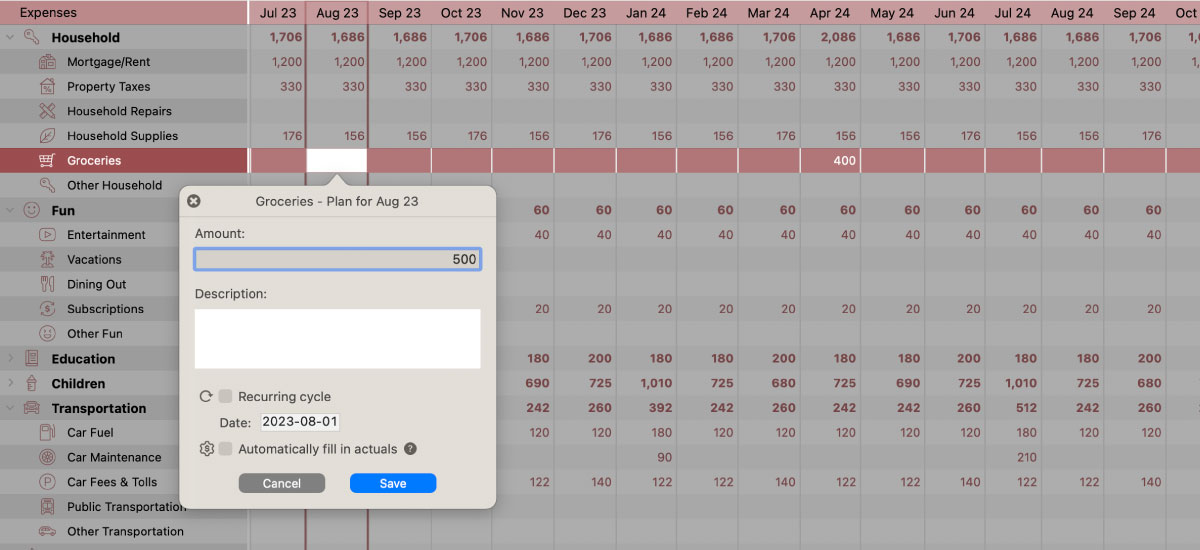

3. Allocate money to each category: After you receive your income, you’ll divide it among the different categories according to your budget. This is done by entering a planned transaction for each category. For example, if you’ve budgeted $500 for groceries for the month, you enter a planned transaction of $500 in your “groceries” category in Cashculator.

Tracking Your Spending

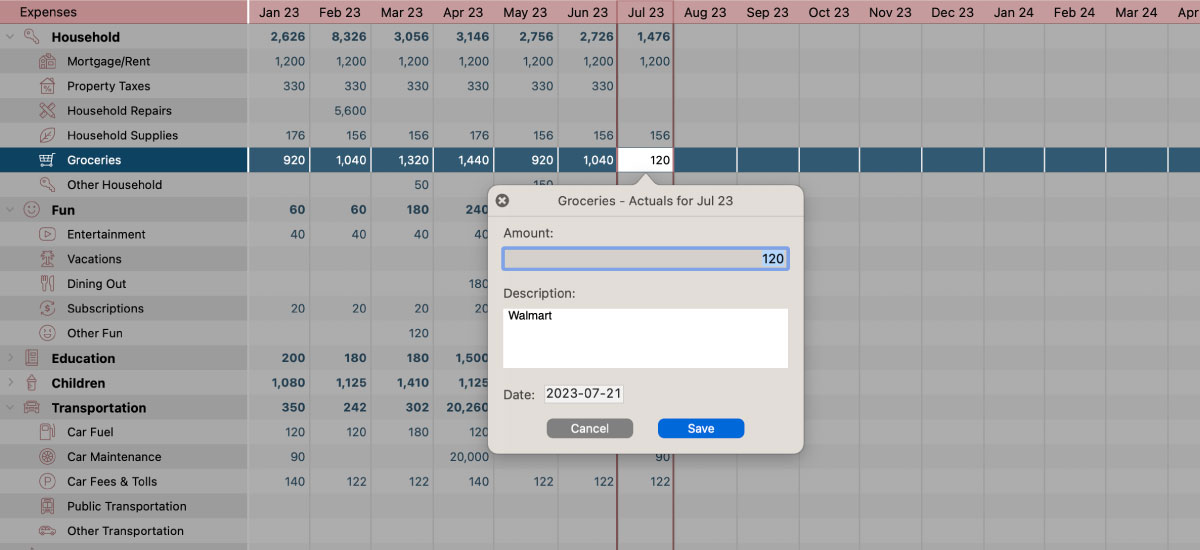

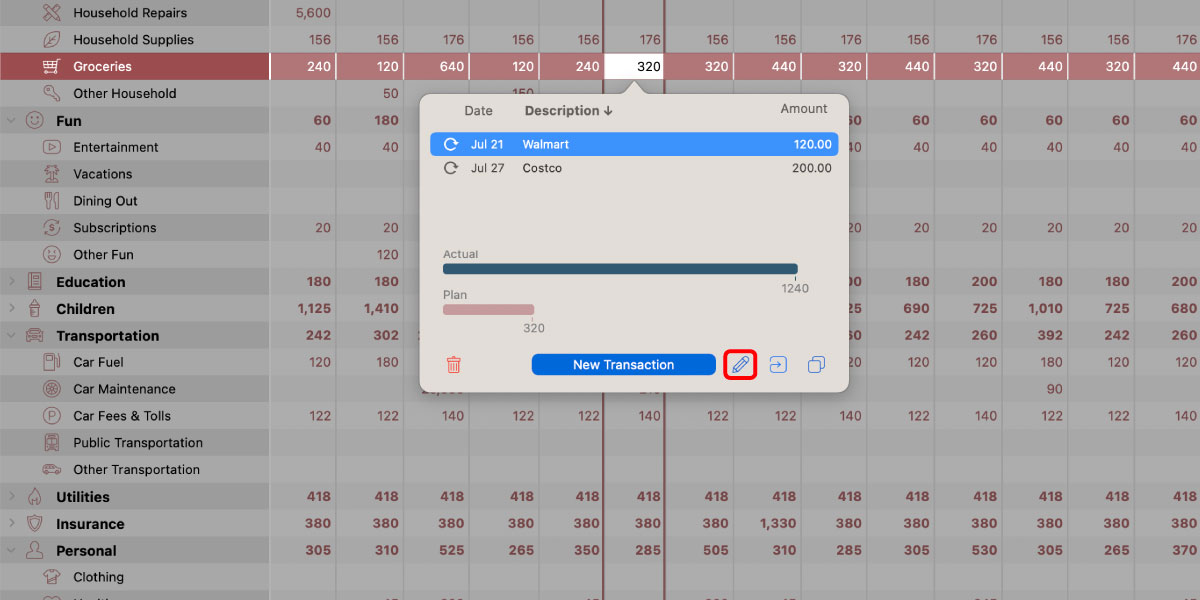

With your budget set up, the next step is to track your spending. Each time you spend money, you enter the transaction in your Actual plan under the appropriate category in Cashculator. Here’s how:

1. Select the correct category and date range: In the expenses table, select the cell corresponding to the transaction’s category and date range.

2. Enter the transaction: With the correct cell selected, enter the amount you spent. You can also add an optional description to help you remember what the expense was for.

Remember, the key to envelope budgeting is only spending what’s in each category. If you run out of money in a category, you must either wait until the next month when you refill the category’s budget or take money from another category.

Comparing Planned and Actual Spending

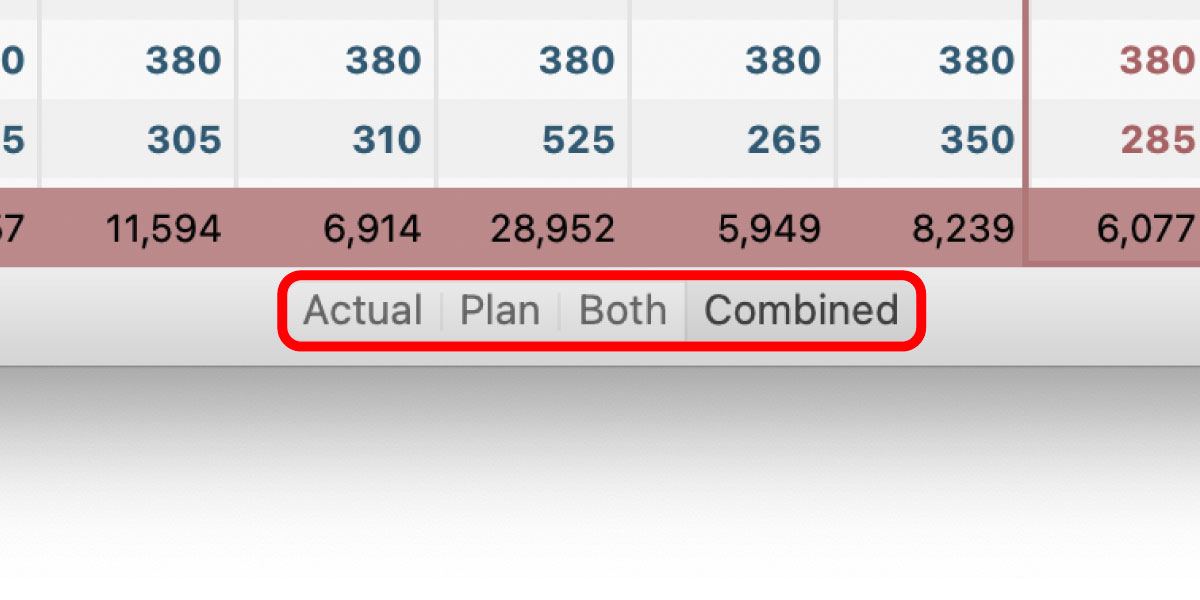

One of the standout features of Cashculator is its ability to separate and compare planned (budget) and actual transactions. This is a crucial aspect of envelope budgeting, as it allows you to see how your actual spending measures up against your budgeted amounts. Cashculator offers four viewing modes to facilitate this: Actual, Plan, Both, and Combined. Let’s delve into each of these modes:

1. Actual Mode: When you select the ‘Actual’ mode in Cashculator, you will only see the actual amounts you have spent in each category. This view is particularly useful for tracking your spending as it happens. Each time you make a purchase or pay a bill, you enter the transaction into the appropriate category, and it will show up in the ‘Actual’ view. This helps you keep a real-time check on your spending and ensures you are not exceeding the budgeted amount in each category.

2. Plan Mode: The ‘Plan’ mode, on the other hand, shows you only the planned amounts for each category. This is the budget you set at the beginning of the month, representing how much you intend to spend in each category. The ‘Plan’ view is a great way to remind yourself of your budget limits and helps you plan your spending accordingly.

3. Both Mode: Perhaps the most insightful of all is the ‘Both’ mode. In this view, each category will show two rows, with actuals on top and planned right below. This side-by-side comparison of your planned and actual spending gives you a clear picture of how well you’re sticking to your budget. If you notice that your actual spending is consistently higher than planned in a particular category, it might be a sign that you need to adjust your budget or curb your spending in that area.

4. Combined Mode: Combined shows plan for cells representing the past and the largest of planned or actual amounts for current and future months. This view is particularly useful for checking if you’re not over budget for this particular month. If you are, the background color of the cells with overspending will be that of the actual transactions view and not of the plan view. The specific color depends on your chosen theme in Cashculator.

By regularly switching between these views, you can keep a close eye on your spending habits, identify areas where you might be overspending, and make necessary adjustments to stay on track with your financial goals. Remember, the key to successful envelope budgeting is not just setting a budget, but also tracking and adjusting it as needed. And Cashculator’s viewing modes are the perfect tools to help you do just that.

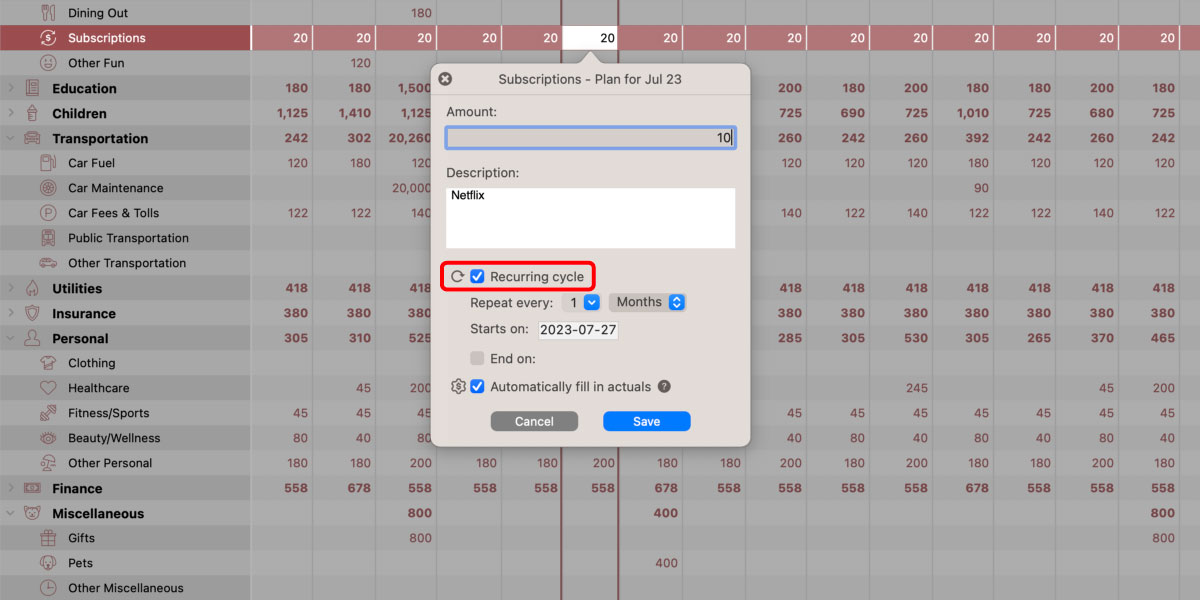

Managing Recurring Expenses

Cashculator allows you to set up recurring transactions, which can be useful for regular expenses like rent or utility bills. To set up a recurring transaction, check the “Recurring cycle” checkbox when entering a planned transaction and configure the repeats. While convenient, the envelope budgeting method involves planning the budget at the beginning of each month. Therefore, use recurring transactions sparingly, preferably only for stable categories like rent, mortgage and other bills that don’t change month over month.

Adjusting Your Budget

Envelope budgeting requires regular review and adjustment. If you consistently run out of money in one category but have money left over in another, you may need to adjust your budget. In Cashculator, you can do this by editing the planned transactions for each category.

Conclusion

By combining the principles of envelope budgeting with the features of Cashculator, you can create a robust system for managing your finances. It may take some time to get used to this method, but once you do, you’ll find that it gives you a clear understanding of where your money is going and helps you control your spending. So why not give envelope budgeting with Cashculator a try? Get Cashculator now!

For more information on how to use Cashculator, check out other articles on this site.

Happy budgeting!

Ready to take control of your spending?

Wish you could forecast future income, expenses and cash flow? Check out Cashculator — Personal Finance today.

Learn how the program works using the free version, then choose a monthly or yearly subscription to unlock unlimited income and expense categories.